Calculating payroll taxes 2023

Increase the payroll tax rate to 161 up from the current 124 with no changes in the taxable income. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to assisting businesses through COVID.

Lydia Austin

As a small or medium-sized business owner it can be challenging to file.

. However you get to claim a deduction for a portion of this when you file your tax return. These rates are effective July 2022 and were set in accordance with KRS 615655 which caps CERS employer contribution rate increases up to 12 over the prior fiscal year for the period of July 1 2018 to June 30 2028. Unfortunately when you are self-employed you pay both portions of these taxesfor a total of 153 percent.

The CERS Board of Trustees met on December 1 2021 and adopted CERS employer contribution rates for Fiscal Year for Fiscal Year 2023. The tax rate calculation. You have to deduct payroll tax from your employees wages.

Estimating your income tax. State governments have not imposed income taxes since World War IIOn individuals income tax is levied at progressive rates and at one of two rates for corporationsThe income of partnerships and trusts is not taxed directly but is taxed on its. Employers are however responsible for deducting the employees income tax liability at source through the pay-as-you-earn PAYE system.

Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to assisting businesses through COVID. Income tax in Australia is imposed by the federal government on the taxable income of individuals and corporations.

Employers who have paid no wages during a calendar quarter will not owe any taxes. Four consecutive no payroll reports will result in an automatic suspension of the employer account by the division. However they are still required to submit an Employers Quarterly Contribution and Wage Report online.

Household EmployerEmployee Tax Rates. UBD to Tax and Customs Administration to change Effective date. You must pay these payroll taxes to the tax authorities.

IRA pension or Section 401k contributions or. If you live in a zone for less than 183 days in 202223 you may still be able to claim a tax offset if you meet each of the following 3 conditions. If mistakes are made when calculating or filing payroll taxes they could result in costly penalties.

Here are the provisions set to affect payroll taxes in 2023. Oregons upcoming Paid Family and Medical Leave Insurance PFMLI program starts in 2023 with employee and employer payroll contributions. 183 days or more during the period 1 July 2021 30 June 2023 including at least one day in 202223 and you did not claim a zone tax offset in your 202122 tax return.

If you are an employee your employer withholds income taxes from each paycheck based on a completed W-4 Form. The payroll tax rate reverted to 545 on 1 July 2022. The Employers portions of federal and state payroll taxes health insurance premiums retirement plan contributions etc are not part of taxable gross payroll.

Even small business owners will benefit from knowing what their indirect costs are and how they impact the business. Tax rates effective January 1 2023 through December 31 2025 will exclude charges from the second third and fourth quarters of 2020 and all benefit charges paid as a direct result of a government order to close or reduce capacity of a business due to COVID-19 as determined by the Department of Economic Opportunity. Calculating payroll taxes Dutch Tax and Customs Administration This article.

Originally Oregons PFMLI was set to start on January 1 2022. Calculating the overhead rate is important for any business. Usually thats enough to take care of your income tax obligations.

But if you are self-employed or make money on your investments or rental property you may need to make estimated tax payments every quarter rather than wait until you file. Employees can use benefits beginning September 1 2023. Other than employers National Insurance contributions see below there are no other payroll taxes the burden of which falls on the employer.

Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. You calculate these employment taxes on a Schedule SE attachment to your personal tax return. Wage tax on share options delayed for employers Effective date.

In calculating net income from the business partners and sole proprietors are not allowed to deduct the following items. The payroll tax rate reverted to 545 on 1 July 2022. Calculating Medicare Tax Once the 2400 threshold is met all wages are considered when calculating the dollar amount of an employees Medicare tax.

You must also inform the aide about the Earned Income Tax Credit EITC which can reduce the amount that a low-income earner owes in taxes.

Paycheck Tax Withholding Calculator For W 4 Tax Planning

2

2

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Oracle Workforce Rewards Cloud 21c What S New

Paycheck Tax Withholding Calculator For W 4 Tax Planning

State Corporate Income Tax Rates And Brackets Tax Foundation

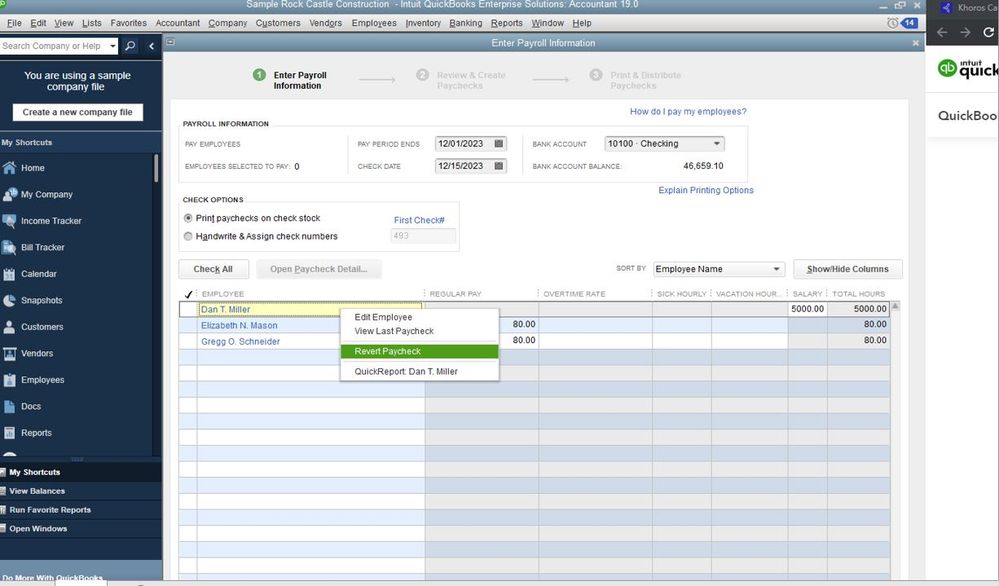

How To Pay Payroll Taxes A Step By Step Guide

How To Pay Payroll Taxes A Step By Step Guide

P9vpfeebhscwzm

Llc Tax Calculator Definitive Small Business Tax Estimator

Social Security Changes That May Be Coming For 2023

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

Expenditures Of Federal Awards Sefa Schedule 16 Office Of The Washington State Auditor

Changes To Corporation Tax From 2023 Calculate Your Increase

Solved Other Payroll Items Not Calculating User Defined Payroll Item

Tax Year 2022 Calculator Estimate Your Refund And Taxes